The discussion about the results of the year for the Russian economy often begins with the question of why it weathered the consequences of the war and sanctions with relative ease. But is it easy? The real decline in economic activity, according to various objective indicators, ranges from 5% to 10% – this is a very serious drop.

Moreover, there are no prospects for any real growth; Putin has failed to create an alternative military economic model. All existing methods of stabilizing the situation – draconian regulation such as the abolition of the free convertibility of the ruble, import substitution, a pivot to Asia, parallel imports, circumvention of sanctions through third countries – are only temporary palliatives and cannot create a sustainable economic system. Apparent stabilization should not create illusions on this score.

First of all, a word or two about the "optical illusion" that accompanies such discussions. If you look at the spring forecasts, most economists did not talk about the complete collapse of the economy, like the collapse of the USSR, but rather about the onset of unprecedented economic difficulties. They have come and are progressing, there is nowhere to hide from them. Further: what is a catastrophe for economists (that very drop in economic activity by 5-10%, few economies in the world fall so strongly, and such a decline usually has far-reaching consequences), for the layman is not something noticeable to the naked eye. People have a different criterion – like food is still available in stores, salaries are being paid, which means that the “collapse” has not happened.

But the economic situation should still be judged by a deep analysis of growing trends, and not by the situation in a neighboring store, otherwise you may encounter an unpleasant surprise, as in the fall of 1991 or in August 1998. Then the trends were clear to everyone and were discussed in detail by economists, but for many Russians who were not immersed in economic subtleties, the complete disappearance of goods in 1991 and the default of 1998 fell like snow on their heads.

What trends are we seeing today?

First. To assess the situation, you should not use a narrow set of macro indicators that economic analysts love, but which in the current situation are manipulated or meaningless – some call them “Potemkin indicators”. First of all, GDP . In peacetime, GDP—consisting of profits, wages, and taxes—gives the economy a further multiplier. Profits are invested, salaries are used to buy goods and services, taxes are used to pay salaries to state employees and some kind of investment in economic projects. In wartime, the composition of GDP takes into account such factors as the production of weapons, ammunition, ammunition for the army, which do not create any multiplier for the economy. A wrecked tank, spent artillery shells, overalls for the military (for example, this year Russia is breaking records for the growth in the production of overalls due to the war) – all this, remaining in Ukrainian soil, does not add anything to the economy.

Therefore, talk that “the decline in GDP was less than expected” is meaningless. Forget about GDP, this is not an indicative indicator today. Economists should consider whether it is necessary to use the indicator of the dynamics of Russian GDP in any serious analysis now.

The same story with unemployment : although nominally it is a record low in the country, if we add hidden unemployment to it (and according to Rosstat, today there are 4.7 million hidden unemployed people in the country (this statistics can be found here on page 229), then it turns out more 8 million people, or more than 10% of the total workforce.The last time we had such a level of unemployment was in 1997-1999.Hidden unemployment is part-time work, layoff or leave without pay.70% of hidden unemployment is just unpaid vacations, which in fact are no different from unemployment.

The last time we had such a level of unemployment was in 1997-1999.

The authorities boast that they have "brought inflation under control." But the methodology of its calculation raises more and more questions. For example, the moderate decline in real disposable income (only 1.5%) announced by Rosstat does not correspond in any way to a stable drop in retail trade turnover of about 10% since April (these volumes do not recover) – it turns out that the Russians earned about the same as last year, but began to make 10% fewer purchases.

Of course, we hear from high rostrums about the “transition of the population to a savings model of behavior,” but it’s hard to believe — especially against the background of VTsIOM data that a third of Russians in 2022 began to save on food and basic services. Most likely, the explanation is that Rosstat discounts real incomes by an underestimated inflation rate – and if you put the real one, then incomes will fall by about the same 10% as retail trade.

The situation is similar with investments : the authorities report their growth (!) by almost 6% over the course of 9 months, although capital is flowing at a record pace since 1994 – the Central Bank predicts a capital outflow of $ 251 billion this year, and it would seem, what kind of investments in such an environment? That's right: if you look at the Rosstat data in detail, then investments are growing in everything that in one way or another can be connected with the war (railway transport, public administration and security, etc.), in construction, the rapid growth in investments in the first months of the year later disappeared to zero, and in such areas as manufacturing, trade, agriculture, telecommunications, there is an investment decline.

Well, the notorious " strengthened ruble ". In fact, the ruble exchange rate has become the main propaganda indicator for the authorities, designed to demonstrate that “everything is fine” and “we are not afraid of sanctions” – both to our own population and in the international PR space. However, firstly, the artificial strengthening of the ruble did not bring any benefit to anyone – only damage to exporters and the budget, which was officially recognized by officials. Secondly, it was achieved by draconian measures that actually destroyed the free convertibility of the ruble. Contrary to numerous praises of the "professionalism of the Central Bank", it is worth noting that the blow to the free convertibility of the national currency of Russia will be remembered for a long time, longer than the default of 1998, more than 30 years of currency liberalization have gone down the drain. And thirdly, there has never been any international demand for the ruble, and the reduction in oil and gas revenues is killing its prospects – since June, the ruble has depreciated by a third, depreciating from 50-odd to more than 70 rubles per dollar, and there is no further way but continued weakening, the Russian currency does not.

More than 30 years of currency liberalization went down the drain

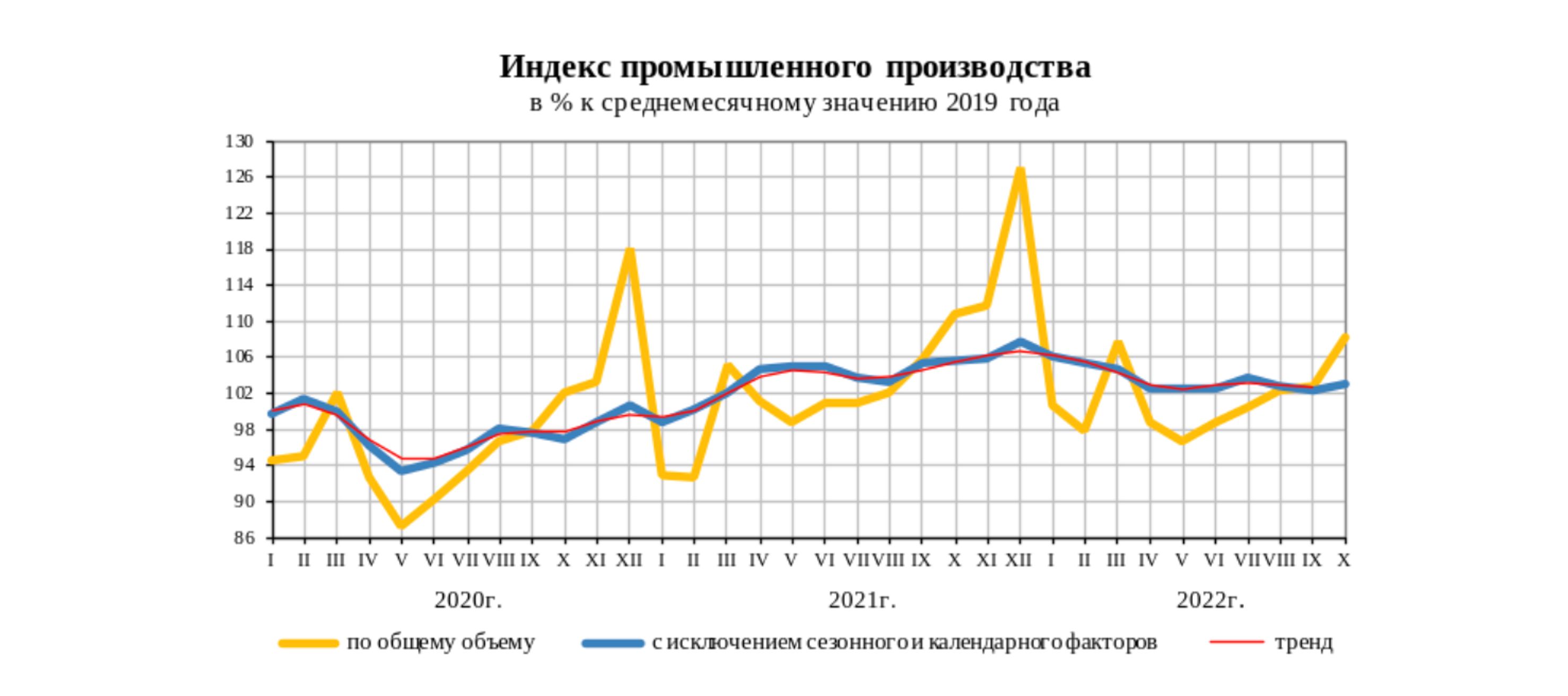

What should be looked at outside the narrow circle of "Potemkin indicators"? For example, Rosstat continues to publish fairly detailed statistics on the state of affairs in the industry. It shows that the collapse occurred in all industries producing more or less complex products – not only in the automotive industry (a drop in production over 10 months is 66% compared to 2021), but also in transport engineering, engine building, household appliances, etc. .d.

All these industries, which have fallen due to the blocking of access to Western technologies and components, are very intensive in terms of jobs (complex assembly plants require a large number of skilled workers), in contrast to, for example, the food industry, which is easier to replace imports, but which has a large number of does not create jobs. The automotive industry alone, according to the government itself, creates about 3.5 million jobs directly and in related industries. And here we see that the manufacturing industry makes the largest contribution to the hidden unemployment already mentioned above: here, more than a million workers are on leave without pay. And in total, more than 25% of the payroll of workers in the manufacturing industry are subject to various forms of hidden unemployment.

More than a million workers are on unpaid leave

The fall began in the raw materials industry: coal production is reduced by 7%, natural gas – by more than 20%. The reason is the break in relations with the European energy market, the situation will worsen dramatically in 2023 due to the entry into force of the European oil embargo. For example, in a recent interview with RBC, the head of Otkritie Bank and ex-Finance Minister Mikhail Zadornov predicted a drop in oil production from 525 million tons this year to 475 million tons next. By the way, the interview is worth reading in its entirety, because Zadornov unexpectedly frankly described all the difficulties that sanctions create for the Russian economy and import substitution – he does not draw any particularly bright prospects.

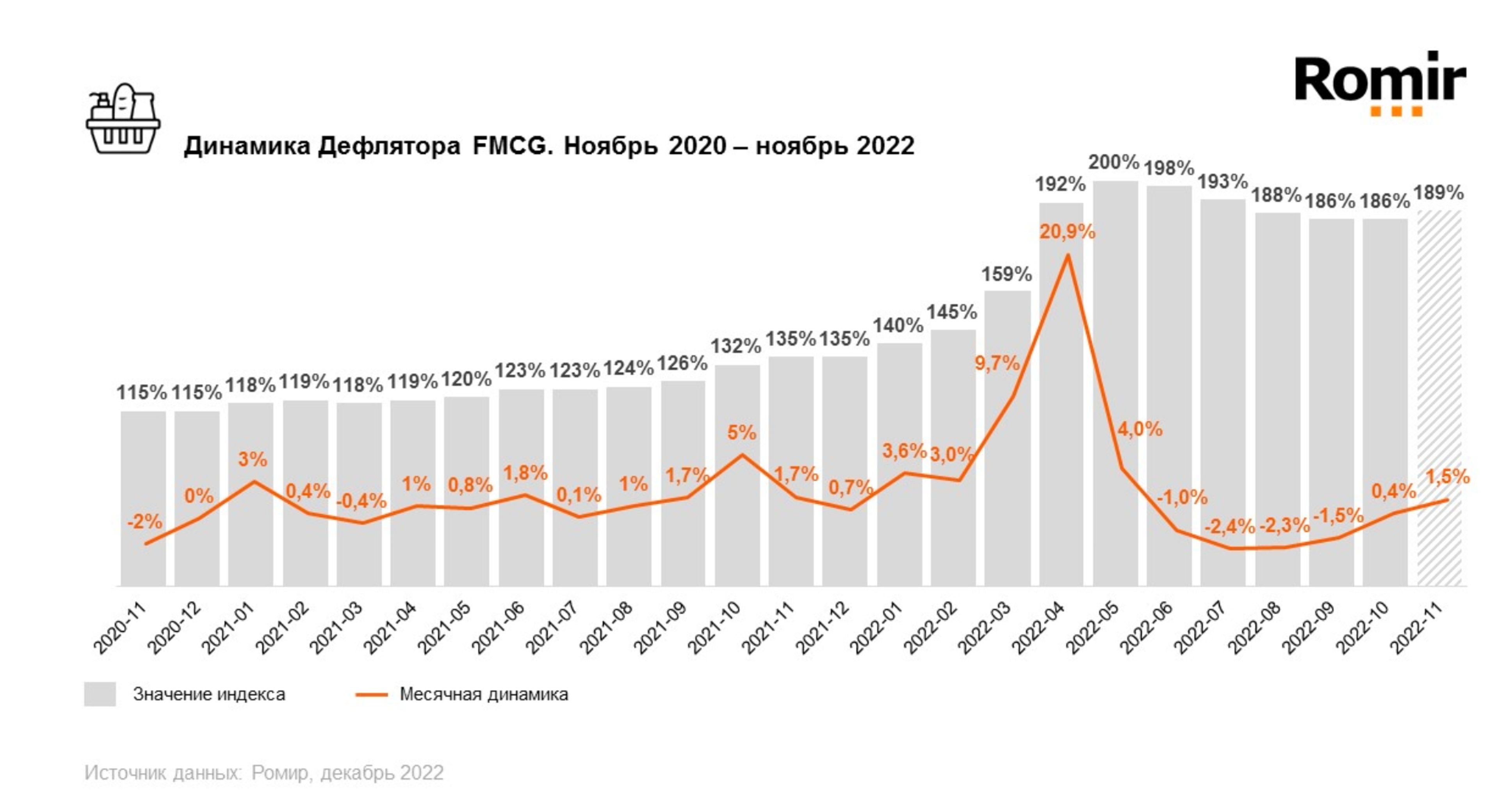

There are deep problems not only on the supply side, but also on the demand side: retail sales have fallen by about 10% year-on-year since the spring, and the situation has worsened since the start of mobilization – as even Putin was forced to admit . Inflation after the spring peak has slightly rolled back, but now it has gone up again – this is shown not only by Rosstat data, but also, for example, monitoring the prices of fast moving consumer goods, which is conducted by Romir.

At a December press conference, the head of the Central Bank, Elvira Nabiullina , lists almost all current trends as pro-inflationary – both the financing of the budget deficit from the NWF, and the mobilization and growth of costs in the labor market, and the restructuring of supply chains to Asia and the rise in the cost of logistics.

With the FNB, everything is also not very good: there are now so-called “liquid assets” (live money not invested in shares and bonds of state-owned companies) worth 7.5 trillion rubles. This year, the Ministry of Finance raised the estimate of the budget deficit to 2% of GDP, or almost 3 trillion rubles. And ahead – the oil embargo and the collapse of budget revenues. Due to the fall in economic activity, non-oil and gas revenues of the federal budget for 11 months fell by about 5% by 2021. The NWF will obviously be spent faster; and in fact, this method of closing the budget deficit does not differ much from the emission of money, which Nabiullina also recognizes. She also states that the state remains the main driver of investment today, private investment is falling. But the depletion of budgetary possibilities means that this process is finite.

The notorious import substitution is not working very well yet – as the data of the same Rosstat show , for the first 10 months of the year, the growth in food production amounted to 0.3%, drinks – less than 4%, meat, milk and eggs – 1-4%, clothes – 0, 5%, textile – less than 10%. The overall growth in agricultural production happened only due to the high grain harvest – the situation is bad for all other positions of crop production, there is either a decrease in production (sunflower, sugar beets) or stagnation (potatoes, vegetables). But for grain, the beautiful picture of the harvest will not last long – farmers complain about the decrease in the profitability of grain production due to export restrictions and containment of domestic prices, and despite the requests of the government, they are already reducing wheat and rye crops.

Against this background, in circles around the government, early victorious reports that Russia is “coping with sanctions better than expected” are being replaced by more gloomy talk that we have somehow passed 2022, but it’s not clear what’s next. The same Zadornov and Nabiullina speak about this, but, perhaps, the director of the ACRA rating agency Mikhail Sukhov formulated this most harshly of all in an interview with RBC: “The time period for the economy to reach the pre-pandemic level is beyond the five-year forecast. I don’t think it’s such a rosy picture.”

“The timeframe for the economy to reach pre-pandemic levels is beyond the five-year forecast”

Rainbow, of course, is not enough. Beyond the five-year forecast – this is, consider, never. The resolving predictive ability of Russian officials does not allow them to see growth on the horizon. The main result of the year is that, having somehow coped with the first blow, the Russian economy begins to look around and understand that there is no positive prospect. For Russians, this means one thing: they will continue to get poorer, and the quality of life will deteriorate. Forget about new foreign cars or the usual quality of cellular communications or the Internet, as well as many other familiar benefits of civilization.

In general, before the start of the war, calculations of the dynamics of real incomes of Russians showed that since the annexation of Crimea in 2014, our citizens have become poorer by 10-15% in real terms. Taking into account the actual (and not the Rosstat) assessment of the real purchasing power of Russians (if we focus on the landslide drop in retail sales), by the end of 2022, the inhabitants of our country turned out to be 20-25% poorer than in 2013. And there are no prospects for improving the situation (“it is beyond the five-year forecast”).

Such is the price of Putin's imperialism and geopolitical adventurism.