Throughout the past year, the domestic real estate market was breaking records. Profile Deputy Prime Minister Marat Khusnullin boasted at the end of December that the volume of housing commissioned in 2022 exceeded 100 million square meters. Vladimir Putin flaunted the same figures, not hiding his joy.

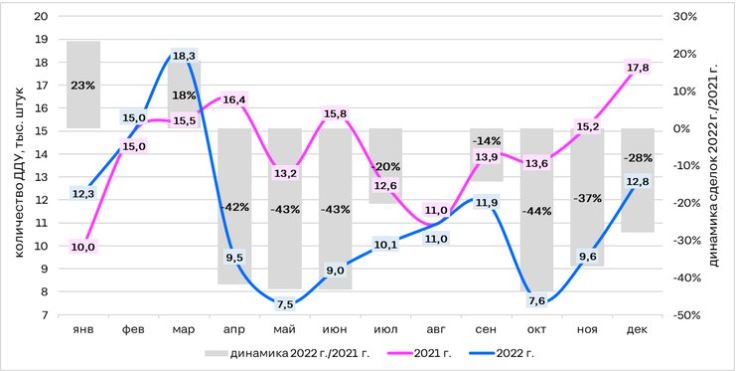

The problem is that, in addition to record volumes, the Russian authorities, in general, have nothing else to brag about. 2022 was an echo of the super-successful years for the real estate market in 2020 and 2021, which, thanks in large part to low mortgage rates and preferential government mortgage programs, broke sales records in both monetary and absolute terms. This is clearly seen in the number of equity participation agreements (DDU). At the height of the coronacrisis, the market received an acceleration from the state with preferential mortgages, and if in 2020 the industry only accelerated by concluding 763.8 thousand contracts, then a year later this figure increased by 17% and reached 898.6 thousand DDUs. In parallel with the boom in the market of new buildings, there was also an increase in demand for secondary housing. In 2021, the authorities recorded 4.2 million sales contracts, which is 14.5% or 500,000 more than in 2020.

War, emigration and mobilization brought the Russian housing market to a depression. Rosreestr has not yet published full statistics for 2022, however, the dynamics of the first three quarters suggests that the market has stagnated significantly. At the end of September, Rosreestr recorded only 533.7 thousand new DDUs, 16% less than a year earlier.

The secondary housing market was sausage all year round. After the start of the war in March, the demand for secondary housing in Moscow immediately increased by 36% compared to February, but already in April it fell back by 38%. In May, the authorities revived preferential mortgages, which shifted the attention of buyers to new buildings, but the mobilization again dispersed the demand for ready-made housing and collapsed interest in new buildings: an increase of 11% against a collapse of 39% in September. As a result, after the mobilization, the market demand remains in favor of the secondary housing. The reason is an excess of supply, the readiness of Russians for discounts and the desire to sell housing as soon as possible.

Useless Records: Too Much Housing

The sea of "black swans" has led to an oversupply in the market. Developers obviously did not include war in their forecasts, so they logically and systematically increased the number of objects to be handed over from year to year. A vivid example is traditionally the hottest real estate market in Russia, Moscow and the region, where in 2020 developers commissioned only 178 residential complexes, in 2021 the number increased to 470, and in 2022 already to 517.

As a result, there were a lot of apartments on the market, and demand collapsed amid the war, instability and uncertainty in income: the volume of housing available for purchase in the Moscow region increased by about 37-50%. At the end of the year, Russians could choose from about 113 thousand apartments in new buildings, for comparison, in January 2022 there were only 75 thousand. According to CIAN, the number of transactions in Moscow and the region for 2022 fell to a record low – by almost 21%: from 339.8 to 269 thousand.

Oversupply in the Russian housing market

A frank excess of supply led to a sharp slowdown in price growth: at the end of the year, housing prices rose by only 6.5%, to 260,000 per square meter, and in real terms (adjusted for inflation of 11.9%), for the first time in a long time, prices fell altogether . By comparison, in 2021, home prices in the Capital Region rose by 28%. The war forced developers to take unprecedented measures – by the end of the year, about 28% of all lots from capital developers were sold at a discount, in 2021 there were only 6%.

At the same time, developers and experts admit that the housing market is largely supported by the preferential mortgage program and preferential offers from developers who have issued loans at a low rate or with a minimum down payment. It was the collapse in demand that forced them to take such steps. However, the super-preferential conditions too quickly attracted the attention of the Central Bank, which tightened the requirements for financial institutions and made such instruments unprofitable by tightening regulation.

An excess of supply was also recorded in the secondary market – since March, supply has grown by about the same 50%, and the average term for selling an apartment has increased from 99 to 128 days. In some months, the supply grew by 8%, according to the federal company "Etazhi", this is a record. At the end of 2022, CIAN estimated the total supply of secondary apartments on the Russian market at 330,000.

Surpluses in the secondary real estate market affected prices more than in the case of new buildings. During the year, a record increase in offers marked “urgent” was recorded, for example, in November, every 25th apartment was sold in this mode. The average discount was 5-8%, and in some cases even reached 30%. The leaders of "urgent sales" were Moscow and the region, Krasnodar, as well as apartments in Makhachkala, Stavropol and Rostov-on-Don. True, at the end of the year, prices in the secondary market of Moscow remained almost unchanged, having risen by only 0.5%. At the end of the year, a square "secondary" in Moscow cost 306 thousand rubles, primary – 320 thousand (an increase over the year by 5%).

At the end of 2022, the average cost of a nationwide secondary square, according to Sberbank, was approximately 99 thousand rubles, according to CIAN (taking into account 18 largest regional markets) – 124 thousand, Floors estimated this figure at 93 thousand. However, everyone notes that after rising in January 2022, prices began to stagnate and began to decline.

Somehow without me: sell by proxy and buy abroad

The war helped the Russian real estate market with another achievement – the number of apartments sold by proxy in the secondary market reached an absolute record. The share of such transactions fluctuates depending on the agency that conducted the calculations. For example, the investment company Flip claims that the share of sales by proxy has reached an astronomical 50%. In "NDV Supermarket Real Estate" they call a share of 20%, and in "MIEL" – 35%. However, in one assessment, the companies are unanimous – there have never been such a number of transactions by proxy in the history of Russia, and the peak occurred during the period of mobilization.

The managing director of Miel, Irina Pesic, notes that the number of transactions by proxy could be even higher – a significant part of the Russians who left before emigrating issued deeds of gift to their next of kin, who later were already engaged in the sale of real estate. It is worth noting that the sale by proxy is often perceived by the buyer with hostility – the Russians are afraid that in this way they are faced with scammers and demand discounts.

In parallel with sales from abroad, citizens set a record for foreign property purchases. The United Arab Emirates (UAE), Turkey, Georgia, Serbia, Thailand, Armenia, Montenegro, Azerbaijan and Kazakhstan, and even European Greece, Spain and Portugal are just a partial list of countries where Russians bought housing in 2022.

Russian companies complained about the collapse in demand in the luxury housing market. According to Intermark Real Estate, the number of completed projects in 2022 fell by 48% and amounted to 620-640 lots. In monetary terms, the market shrank by 32.4% to 42.8 billion rubles. A significant part of this money went to the Arab market, because it was the UAE that became the main direction for buying real estate among Russians, and especially the wealthy.

Betterhomes agency estimates the impact of Russians in the UAE real estate market at a record $56.6 billion, and the total number of transactions broke the historical record of 2009 – 86,000 against 80,000 14 years ago. In monetary terms, transactions increased by 80% compared to 2021, which allowed Russians to become the main foreign buyers of local real estate.

Not all countries publish information about the purchase of real estate by foreigners, but there are plenty of reasons to believe that Turkey has taken the second place in terms of housing sales by Russians. The republic turned out to be one of the few countries with very loyal legalization conditions for Russian emigrants, and in the case of buying or long-term rental of housing, foreign citizens can apply and receive a residence permit.

The Russians set records in the markets of the UAE and Turkey

According to official data from the Institute of Statistics of the Republic of Turkey, in 2022, Russians purchased a total of 16.2 thousand properties, which is almost three times more than in the whole of 2021, when 5.2 thousand were sold. As in the UAE, such a sharp jump allowed Russian citizens to lead the local rating of foreign property buyers.

In third place among the Russians, apparently, was Georgia. According to the local Ministry of Justice, in 2022, 12.3 thousand Russian citizens purchased 15.1 thousand real estate objects, of which 13.2 thousand were houses and apartments. For comparison, a year ago, only 3,739 Russians purchased 4,332 real estate objects from the country, and in 2020 even fewer – 2,366 citizens and 2,701 objects. Growth for the year was 71.5%.

Other countries have not yet published detailed statistics, however, real estate agencies record a sharp increase in demand in the markets of Armenia, Kazakhstan, Azerbaijan, Serbia and Montenegro, relatively accessible to Russians, as well as in the markets of Thailand, Cyprus, Greece, Spain and Portugal. All are united by a multiple increase in demand, as well as a significant increase in prices in local markets, caused by the influx of Russians. Depending on the volume of demand, the price of real estate in the declared markets has increased on average over the year in the range from 10 to 30%. For example, in Thailand, Russians bought only 263 real estate objects during the year, but the increased interest of Russians still spurred prices.

Mortgage bubble: without preferential loans, the industry is facing a crisis

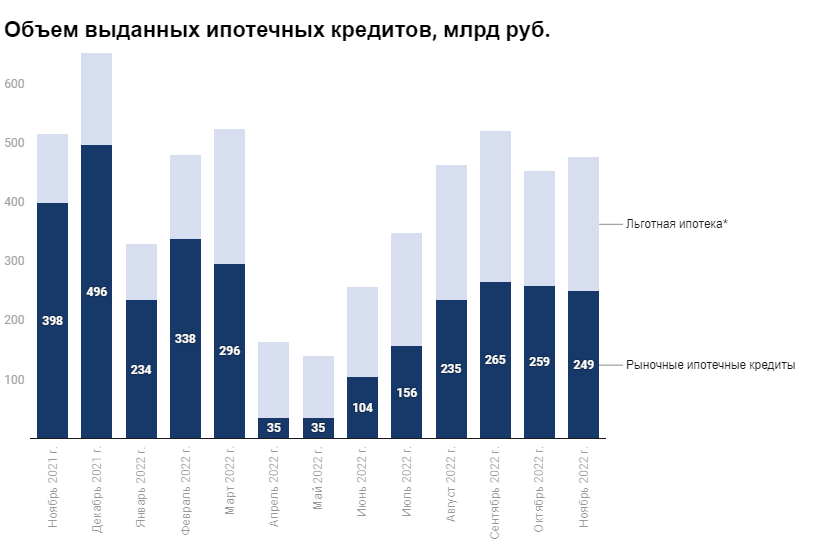

Having lost their living money from wealthy Russians, the only thing left for the market to hope for is a mortgage, which is why realtors and developers spent the end of 2022 nervously. The authorities delayed the decision whether to extend the preferential mortgage program, almost until the holidays. As a result, the construction lobby won: the “preferential mortgage” and “family mortgage” programs with rates of 8 and 6% per annum, respectively, were extended until June 1, 2024.

It is worth recognizing that not only market participants were nervous, but also ordinary Russians. On fears about the termination of preferential programs, banks managed to set a new monthly mortgage record and issued loans for 701.3 billion rubles – twice as much as in November 2022. The number of credit agreements themselves in December amounted to 177.9 thousand, which is 37.14% more than in November. Another record was set for the proportion of transactions that fall on mortgage money, in December this figure rose to an astronomical 84%.

More than 80% of transactions for the purchase of housing in December were mortgages. This is an absolute record

The share of preferential mortgages in the total volume of loans issued in the primary market reached 81% in November. Thus, the giant industry becomes dependent on a single instrument, which creates risks that have already been discussed even in the State Duma.

Deputy Nikolai Arefiev is convinced that the exodus of foreign companies, coupled with a drop in incomes of the population and an increase in the debt load of Russians, is an undeniable basis for the coming mortgage bubble. He believes that the crisis will cover everyone at once: Russians, banks, and the construction industry, and it will not be possible to solve the problem without state subsidies:

“Mortgage payments are very high now. They used to be tall. I do not know the latest figures, but the fact that the bubble was growing and the crisis of non-payments was to come is obvious. The bubble is starting to burst and getting out of this problem will not be easy. Without public investment, we will not solve it.”

Alina Rozentsvet, CEO of the National Rating Agency (NRA), also hints at problems with the solvency of Russians. She agrees that the acceleration of the construction industry with the help of preferential loan programs, coupled with the fall in real incomes of Russians and high inflation, create real risks of inflating a bubble in the market. At the same time, she admits that it is still too early to talk about the implementation of a tough scenario – banks are conducting a very thorough check of potential borrowers, and the Central Bank has actually destroyed loans with zero or minimal down payment.

Irina Nosova, director of the group of ratings of financial institutions of the ACRA credit rating agency, believes that there are serious arguments in favor of a gradual increase in risks. They are connected primarily with the high level of debt load of citizens, the instability of the economic situation and, most importantly, the uncertainty of prospects in the near future.

Representatives of real estate agencies are more optimistic. In their opinion, it is premature to talk about a bubble, the key argument is the low percentage of mortgage delinquencies. According to the Central Bank, there are only 0.5% of all loans. However, the absence of delays now does not mean that they will not be in the future. Rates have been raised, but incomes are falling , it is very doubtful to expect that in such conditions the payment discipline of Russians will grow.

“Although the overall level of debt burden did not increase significantly at the end of the year, Russians are increasingly starting to apply to banks for new loans in order to pay off old ones, the proportion of people who take out a second or third loan is growing, and the number of applications for declaring individuals bankrupt is growing,” — says Ruslan Sukhy from Rentaveda.

What will happen to prices and the market?

At the same time, the decline in the well-being of Russians and the fall in demand is unlikely to have a global impact on prices for new buildings. Most likely, companies will prefer to arrange seasonal sales and gradually reduce the volume of supply in order to prevent an excess of apartments on the market. However, even here there is a high risk of losing a buyer, who may go to the secondary market or even refuse to buy a home. Developers, on the other hand, will most likely come up with new marketing campaigns, such as, for example, the idea of one of the largest developers – the PIK group of companies, together with Tinkoff Bank, launched a mortgage cashback. Thus, citizens can compensate themselves for part of the initial contribution.

“If prices remain the same as they are now, then without an increase in real incomes of the population, with the abolition of mortgage subsidy programs, demand will partially go to the secondary housing segment; notes the expert of "Cyan.Analytics" Victoria Kiryukhina.

"Resale" is in many ways more profitable than new buildings. The volume of supply for 2022 has grown significantly, and prices are more democratic than in new buildings, plus there is always the opportunity to bargain. That is why many realtors are inclined to believe that in 2023 one can still expect a slight decrease in prices for new buildings, however, experts disagree on the amount of the discount: they expect from 2 to 12% by the end of the year. Most experts admit that the sharp increase in the number of second homes on the market is a direct threat to the construction industry, and no one seems to understand how to solve this problem.

The Russian real estate market in 2023 will be held hostage to the war with Ukraine – any new wave of mobilization or some kind of shock will only hit sales and housing prices harder. The industry's high level of dependence on credit and public money creates risks of instability for construction companies, whose profitability is highly dependent on the number of sales.

A combination of factors can shift the market from a state of depression into a real existential crisis, which will pull other industries, primarily banks, with it. True, experts assess the likelihood of such an event as low so far, but many people also assessed a full-scale invasion of a neighboring country a year ago with great skepticism.