Against blogger Alexandra Mitroshina, a case was opened on tax evasion for 120 million rubles, TASS writes , citing a representative of the Investigative Committee.

According to investigators, Mitroshina, as an individual entrepreneur, received income from educational courses in excess of the limit allowed for the application of the simplified taxation system. In order to hide her income, she allegedly received part of them for other individual entrepreneurs affiliated and controlled by her, according to the UK.

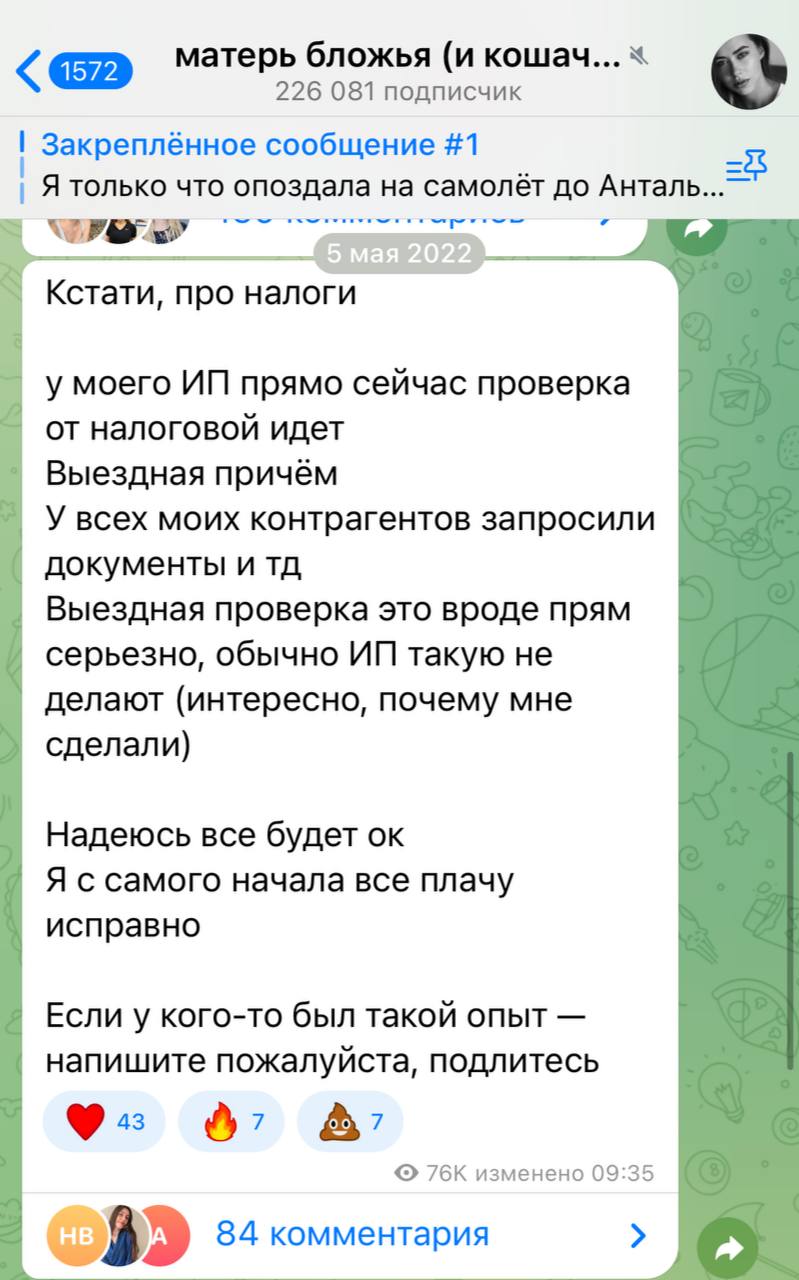

Mitroshina herself has repeatedly talked about how she runs her business and claimed that she “regularly pays all taxes”:

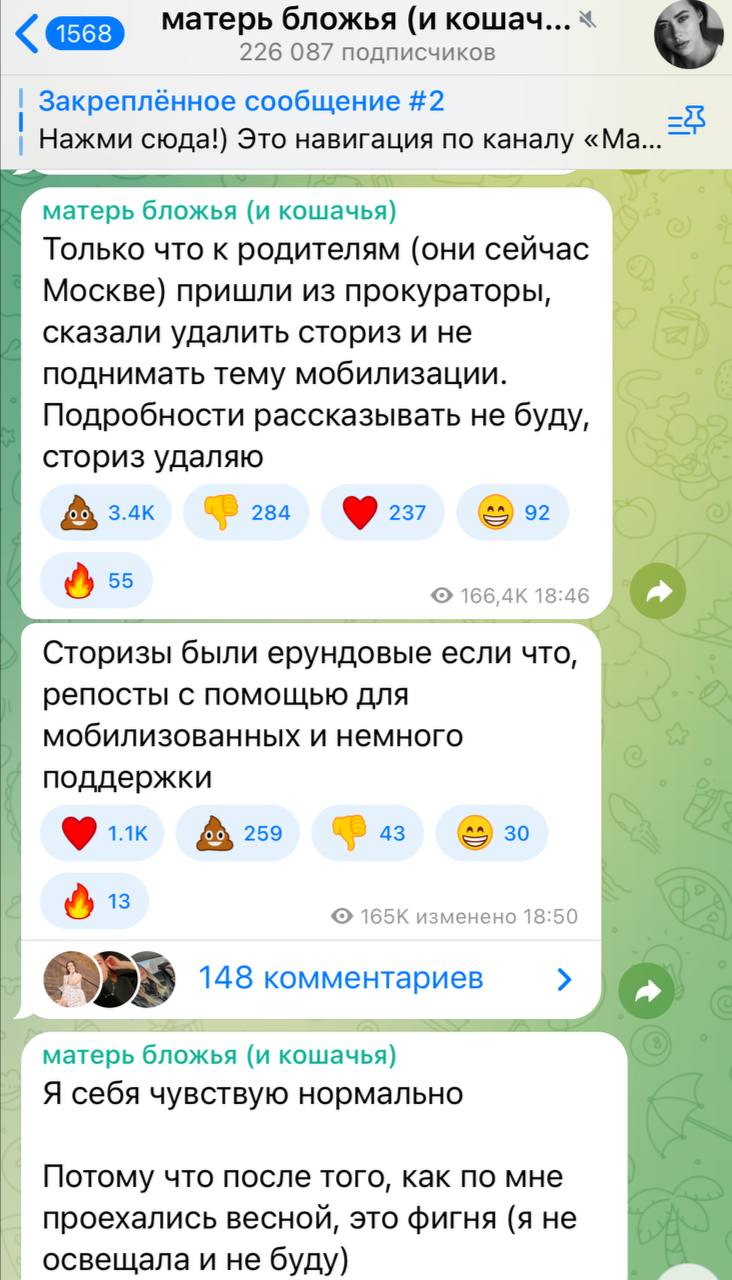

After the start of the Russian invasion of Ukraine, Mitroshina publicly opposed the war and left Russia. She currently lives in the UAE. Mitroshina also said that because of her political position, she faced pressure, but did not disclose the details.

This post is sponsored by our partners Wigs

On March 16, a criminal case was opened against blogger Valeria Chekalina and her husband for laundering money obtained by criminal means. This is the second case against the spouses, who were previously accused of tax evasion.

Some time before this, the media wrote that the Federal Tax Service would soon begin a large-scale check of the “stars” of the Internet. In particular, the tax authorities allegedly became interested in the income of the author of the “Marathon of Desires” Elena Blinovskaya, the founder of the business club “Transformer” Dmitry Portnyagin and the wife of rapper Dzhigan Oksana Samoilova.