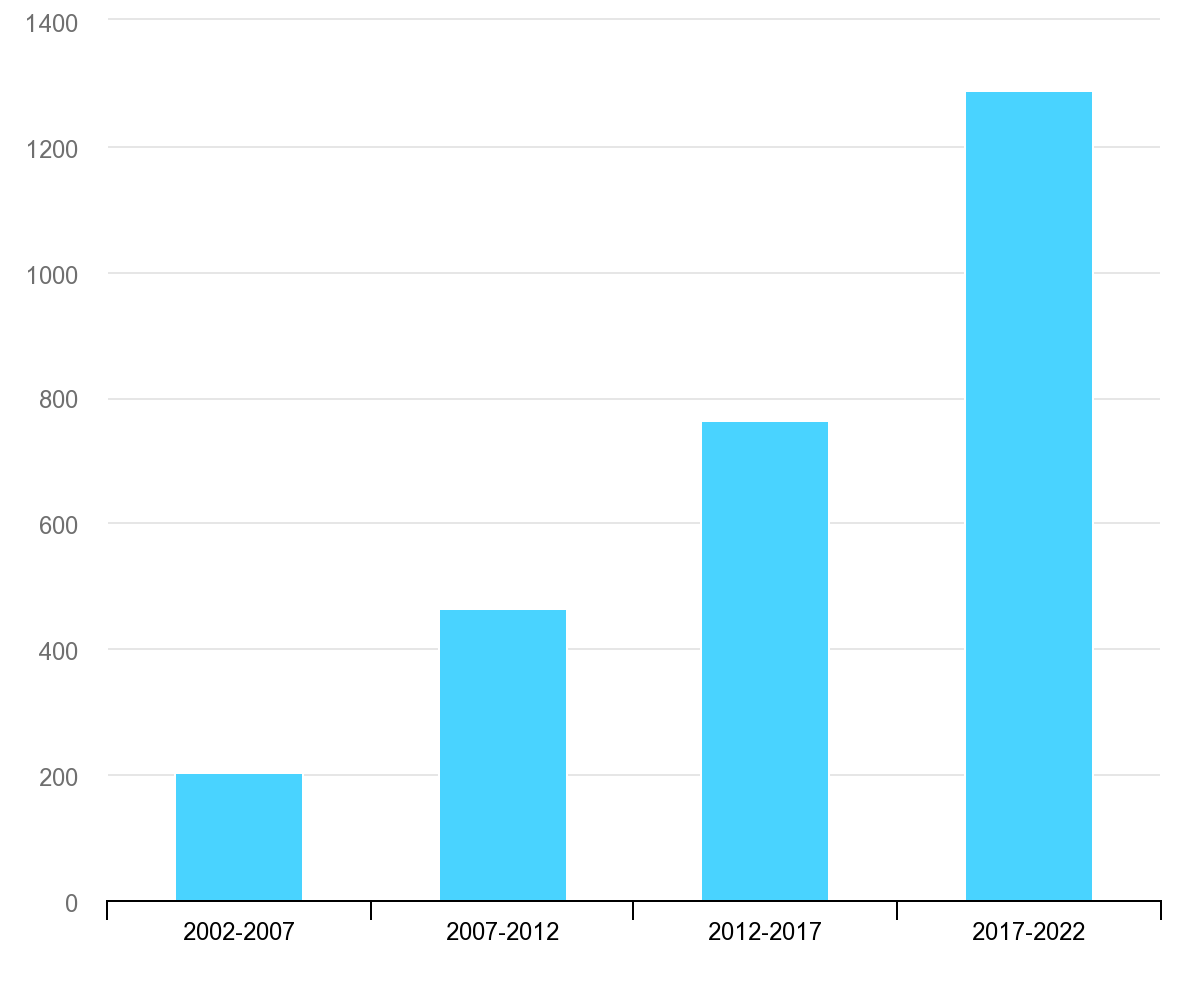

Since the start of Russia's full-scale invasion of Ukraine, the pace of the energy transition from hydrocarbons to renewable energy sources (RES) on a global scale has accelerated sharply: in 2022 it grew by 30% compared to expectations a year earlier. According to forecasts , global renewable energy capacity from 2022 to 2027 will grow by 2400 GW, which is equivalent to the amount of capacity in China today. And by the beginning of 2025, RES will take away the title of the largest source of electricity in the world from coal. Investment in the industry is also growing. According to the calculations of the specialized agency IRENA, global investments in technology in 2022 reached $1.3 trillion, and by 2023, according to the International Energy Agency (IEA), their volume will exceed $2 trillion by 2030.

The war and the oil embargo have only accelerated the transition to "green" energy, which is increasingly talked about in recent times. Over the past two years, all the key players in the global economy have announced plans to achieve zero carbon emissions in 2050–2060 and have fixed them in policy acts and laws that imply huge government injections into renewable energy and support for this sector.

The common good and the attempt to stop climate change is only one side of this huge investment in renewable energy. The second is the intention to gain the right to participate in the promising and constantly growing green market, influence it and, most importantly, maintain energy security, which has been and remains a key motivation in the development of green technologies.

Solar panel market: Chinese dominance

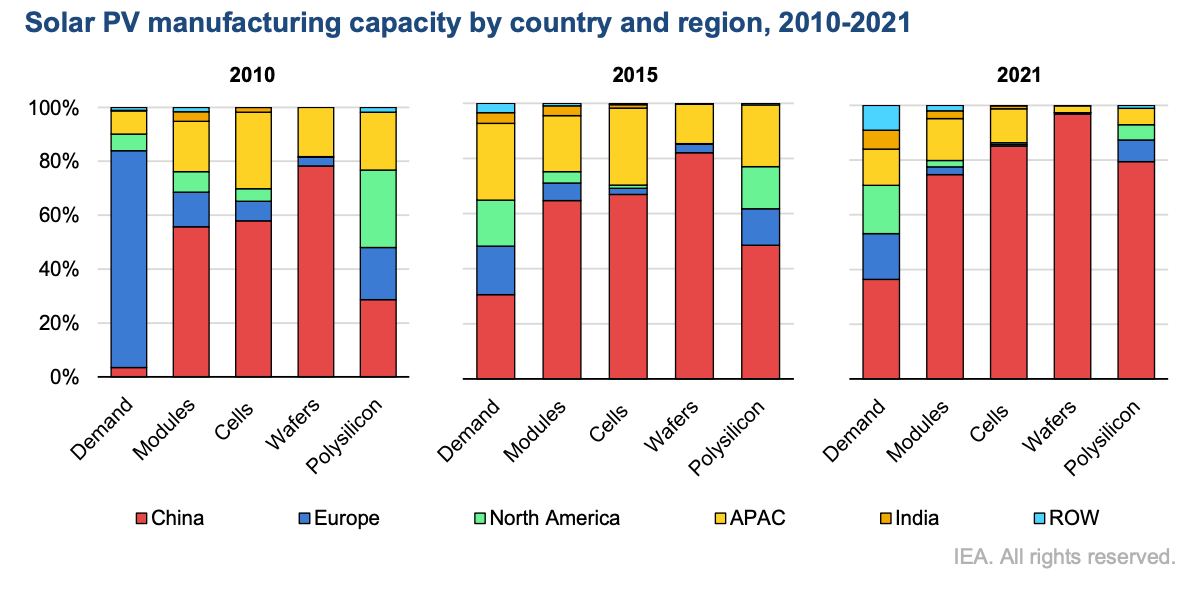

In July 2022, the IEA released a report on the threat of Chinese dominance in the solar panel market. The organization fears that some links in the production chain are almost entirely dependent on Chinese companies.

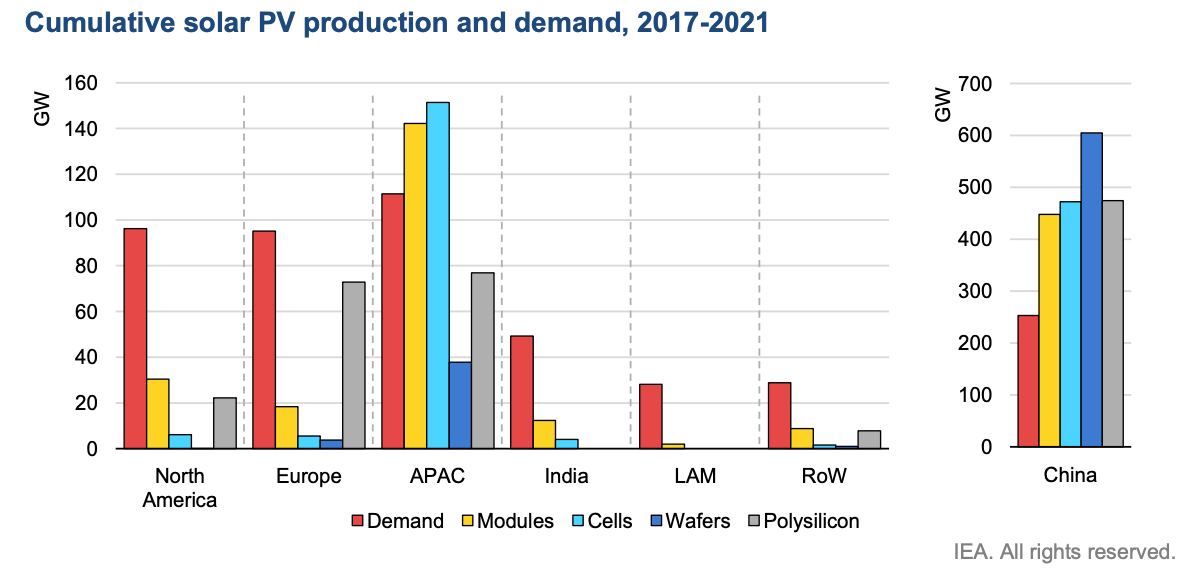

According to the report, the country's share in all stages of solar panel production today exceeds 80%, and for key elements, including polysilicon and wafers, it will grow to more than 95% in the coming years, based on the volume of production capacity being prepared for launch.

In addition, in 2022, China held about 70% of the wind turbine market and also controlled more than 70% of lithium and 50% of nickel refining capacity, according to S&P Platts.

Market participants fear not only that China, having monopolized the market, may dictate the terms, but also problems such as interruptions in production and supply. For example, a lockdown, a flood or a fire at a factory. The report states that high raw material prices and existing supply chain bottlenecks have already led to a 20% increase in solar panel prices in 2021-2022 and delays in their delivery around the world.

The strengthening of China's position in the solar panel market, as well as in the renewable energy market in general, did not happen in a couple of years. This story began back in the 1990s, when the largest importers of hydrocarbons stepped up research in the field of renewable energy and for the first time subsidized their use for households. The production of solar panels, as well as wind turbines and components for them, in developed countries (USA, Japan, Germany, Italy) was expensive, and subsidies and feed-in tariffs created demand from end-users. Chinese companies took advantage of this situation and quickly responded to the shortage by expanding production capacity and increasing supplies to the US and European markets.

China first bought technology licenses from Western companies and implemented them under supervision. But by the mid-2000s, the market volume had grown and it was time to collect stones: Chinese shareholders began to buy shares from foreign investors and force them out of the local market (in 2008, Goldwind acquired 70% of the shares of the German company Vensys). In addition, in the solar energy market, the country has actively invested in its own developments, creating test sites and subsidizing companies in the industry. As a result, Chinese companies today own a number of unique technologies.

Chinese companies today own a number of unique technologies

The development of renewable energy in China takes place within the framework of the "five-year plans". The current plan (2021-2025) involves laying the foundation for the country's energy transition, peaking emissions by 2030 and carbon neutrality by 2060.

As a result of the 14th plan, China is expected to account for almost half of the new global renewable energy capacity through 2025, and domestic clean energy production to grow by 50% by the end of the five-year period.

The amount of funding for the industry from China is in line with the ambitiousness of its plans. In 2022, almost half of global investment in low-carbon projects ($546 billion) came from China, according to BloombergNEF analysis . This is nearly four times the amount of US investment of $141 billion. The European Union was second only to China with $180 billion in energy transition investment.

However, it is worth recognizing that, despite this amount of financial support for the industry, China remains the largest emitter of carbon dioxide in the world. Moreover, coal will remain the second pillar of the country's energy policy for the next decade, which should reduce the risks of interruptions in the system, where the share of renewable energy is growing.

US response: technological protectionism

The IEA report on the threat of Chinese dominance in the solar panel market was released in the summer of 2022. Just two months later, US President Joe Biden signed a truly historic document for the development of the US green energy market – the Inflation Reduction Act (IRA), which should encourage investors to invest in the US renewable energy market and give local companies privileges over foreign competitors. .

The US will provide about $737 billion in government funding, of which $369 billion is in subsidies to support the clean energy industry. These include electric vehicles (EV) and batteries, hydrogen, energy storage and transmission technologies, and supply chain diversification. One condition: production must be located in the USA. As a result, by 2027, China's share in production capacity may decrease by 10-15%, although it will remain the dominant player. The US, in turn, should increase its share.

Thus, the Inflation Reduction Law will work at two levels at once – local and global. Locally, the Biden administration is pushing for a resurgence of US manufacturing, believing that the loss of production – due in part to competition with China – has weakened US security and hurt the economy. The loss of manufacturing jobs has also eroded voter support for Democrats in industrial swing states such as Michigan, Pennsylvania and Wisconsin. At the global level, the United States wants to build a reliable supply chain that will reduce the role of China in the supply of critical technologies and materials for green energy.

The Inflation Reduction Act is not the only U.S. initiative to strengthen industries, which Biden says will enable "not only to compete with China in the future, but to lead the world and win the economic competition of the 21st century." The CHIPS Act, also passed in August 2022, provides $52.7 billion in subsidies for research, development, and manufacturing of semiconductors in the US. This has already led Taiwanese semiconductor company TSMC, as well as US companies Intel, Micron and IBM, to announce investments in the US totaling about $200 billion.

Resistance and criticism from the European Union

The protectionist policy of the United States in relation to its own "green" market has caused sharp criticism and confusion on the part of officials and the business community of the European Union. First, the Inflation Reduction Act violates WTO rules that have been in place for decades and forbid any member country from placing its own producers in a privileged position in the market. Secondly, Europe suffers much greater losses from the war in Ukraine and from the cessation of purchases of Russian hydrocarbons. The third reason is the limited “response”: if the EU approves a package of counter subsidies, it will not only violate the same WTO rules, but also enter into a technological race with the United States, which runs counter to its long-term geopolitical strategy and the concept of transatlantic energy security (especially in the context of the war in Ukraine and the rise of China).

Europe suffers much greater losses from the war in Ukraine and from the cessation of purchases of Russian hydrocarbons

A month after the signing of the law, in September 2022, European Commission President Ursula von der Leyen advocated the creation of a new European sovereign wealth fund and a hydrogen bank. Then, in October, a special bilateral group began working to discuss the implications of the IRA for European manufacturers. In December, as part of a visit to Washington, French President Emmanuel Macron personally asked his American counterpart to amend the bill.

Annoyance over the IRA has further intensified as several European energy companies announced they might invest in the US or relocate offices.

Without waiting for truly mitigating changes from the United States, in early February, the European Commission announced the launch of a new green energy plan. Its essence boils down to adaptation based on the "strengths" of the EU: regulation, open market, external communications. In particular, companies will be able to obtain permits faster, subsidies will be provided, the labor market will receive new specialists in a growing industry, and the EU plans to establish close international trade ties (in particular, we are talking about Mexico, New Zealand, Australia and India).

Without waiting for changes from the US, the European Commission adopted a new plan for green energy

The plan includes an additional €250 billion in addition to the already announced programs aimed at decarbonizing the EU.

If once the energy transition looked like a “green flash mob” of developed countries for the sake of climate goals, then by 2023 this period has finally come to an end. In just the last two years of crisis, green energy has managed to rise to the global level, where instead of country and regional trends, growing tension between the United States and China has an increasing influence. Europe, which is experiencing the consequences of the severing of energy ties with Russia, is likely to be forced to balance as a third force for the sake of resources, markets and security.

The United States is unlikely to take the lead or even overtake the European Union in the green technologies market in the next decade, while maintaining the current volume of investment by each of the parties. But it will still be able to ensure energy independence, for which the country fought for so long during the outgoing hydrocarbon era, and localize key production chains on its territory with the help of multibillion-dollar injections.