The largest investment and financial conglomerates of the planet that have joined the Net-Zero Banking Alliance (NZBA, zero emissions banking) practically do not work in the direction of reducing their carbon footprint and continue to regularly finance projects and companies from the field of hydrocarbons (coal, gas and oil ). Moreover, in most large banks, the share of financing of "dirty" companies still exceeds the share of "green" ones, although financial companies have committed to do exactly the opposite, writes Bloomberg.

The NZBA was founded in April 2021 with the support of the United Nations (UN), which called on the largest financial groups to increase funding and investment in green projects that should facilitate a faster transition to clean energy sources, as well as help reduce emissions, which should stop the growth of the average temperature on the planet.

The members of the association committed themselves to making efforts so that investments in clean projects exceed investments in "dirty" projects by 4 times: that is, $ 1 of oil and gas or coal money would account for $ 4 dollars of "green technologies" or renewable energy sources. They committed to achieve this level of investment by 2030. For comparison: at the end of 2021, $1 of “dirty” investments accounted for only $0.92 of “clean” ones.

"That's the number one challenge," said Adair Turner, former head of finance at London City Hall, commenting on the desire of the UN and associations to force the world's largest banks to increase funding for green technologies. In second place, according to him, is the task of increasing concessional lending to "green projects" in developing countries.

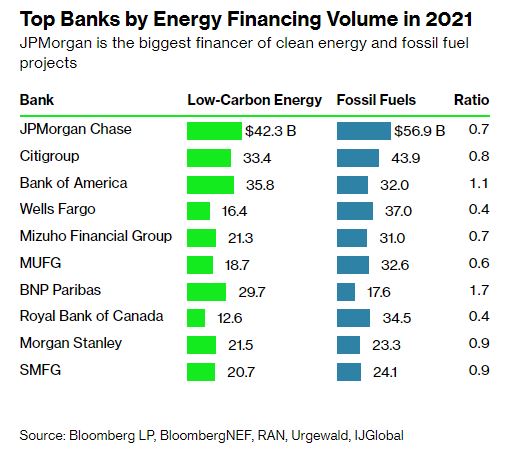

Most banks from the association do not yet even have a 1 to 1 ratio in terms of financing "dirty" and "clean" projects. For example, the largest US bank JPMorgan Chase & Co. this ratio is approximately 0.7 to 1. Citigroup Inc. performs better. and Bank of America Corp., which are 0.8 and 1.1 to 1, respectively. Worst on the list were American Wells Fargo & Co. and the Canadian Royal Bank of Canada – 0.4 to 1 each. The best result is from the French BNP Paribas – 1.7 to 1. At the same time, none of the 10 largest members of the association improved its performance over the past year, the agency notes.

“We can still limit global warming to 1.5°C, but banks will let us down if they don't rethink their lending and underwriting practices,” said Lucy Pinson, founder and director of environmental nonprofit Reclaim Finance.

In 2021, cumulative bank investments in energy were estimated at $1.2 trillion, of which $585 billion went to low-carbon energy and $636 billion to fossil fuels. Among the largest banks of the association, the ratio averages 0.92 to 1, and for all members of the association – 0.81 to 1. It is worth noting that outside the association this figure is even lower: 0.64 to 1.

The agency understands the following instruments as investments and financing: loans, bonds, equity capital and project financing, which were directed to the implementation of various energy projects. In total, cash flows in favor of 2895 companies from 1142 financial institutions are being studied. Some financial institutions were dissatisfied with the results of the rating. For example, JPMorgan, in its commentary, indicated that the rating does not take into account tax incentives for "green projects" and financing of such projects, even if they are unprofitable. According to the bank's estimates, experts missed about $5 billion in "green" investments.