Dmitry Kiselev announced in Vesti Nedeli that the dollar is losing its status as the world's reserve currency, and the "anti-Russian" policy of the United States plays an important role in this:

“As they thought in the United States, active participation in the conflict in Ukraine and anti-Russian sanctions should have weakened, and ideally destroyed Russia. In fact, everything happens exactly the opposite. America is sounding the alarm: if the Biden administration continues in the same vein, then the dollar as the world's main reserve currency will come to an end, and hence the hegemony of the United States in the world, too. <…>

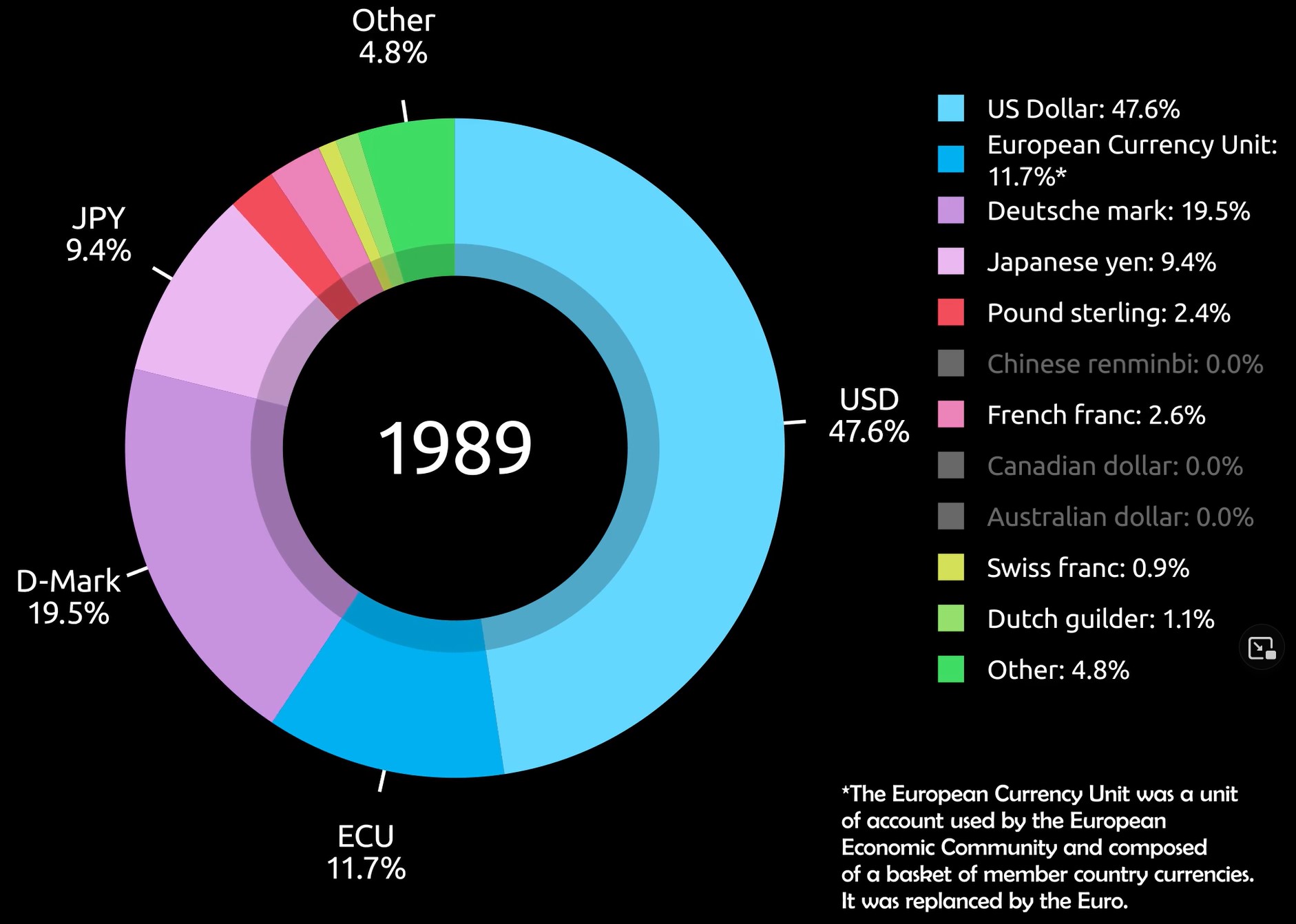

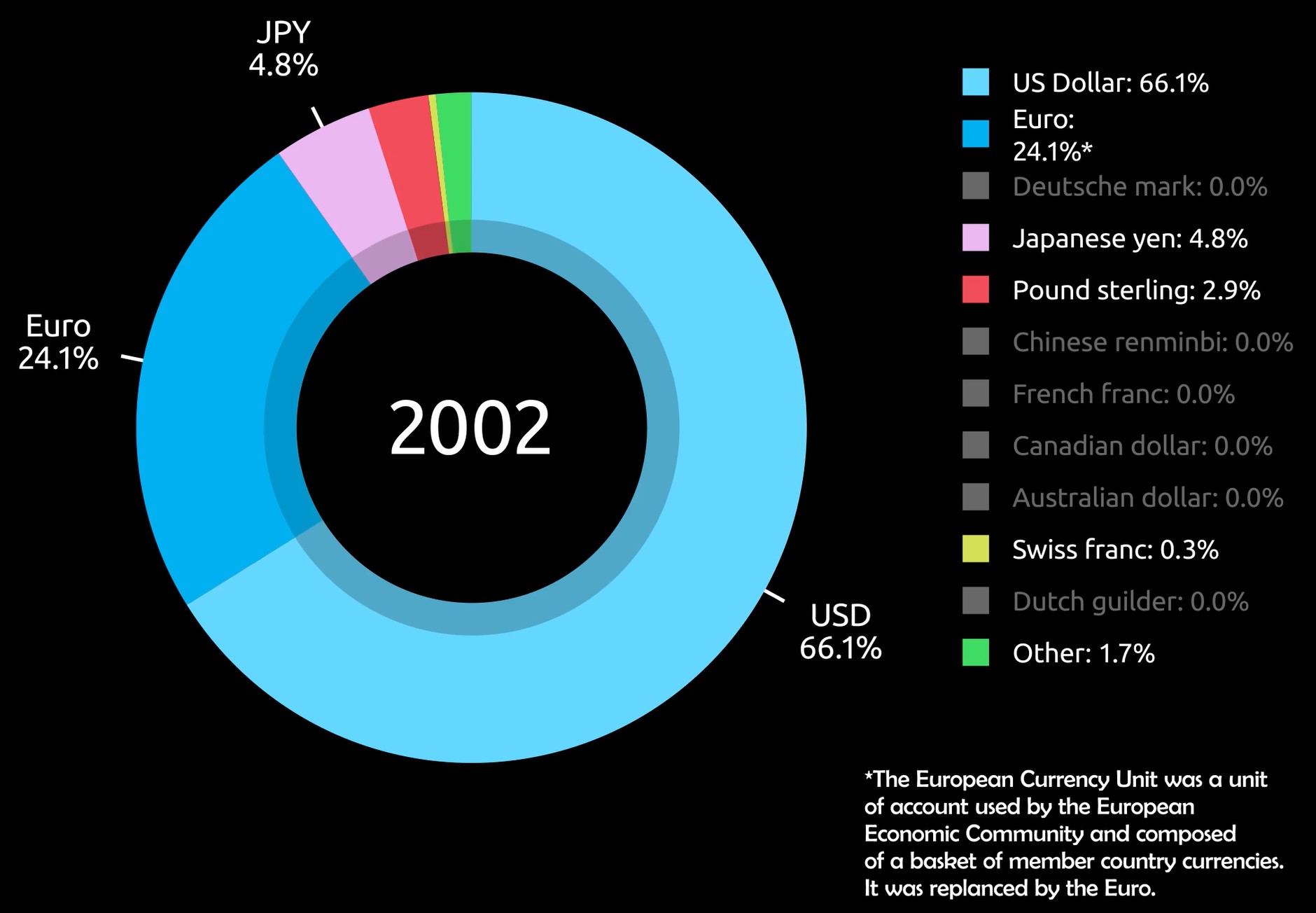

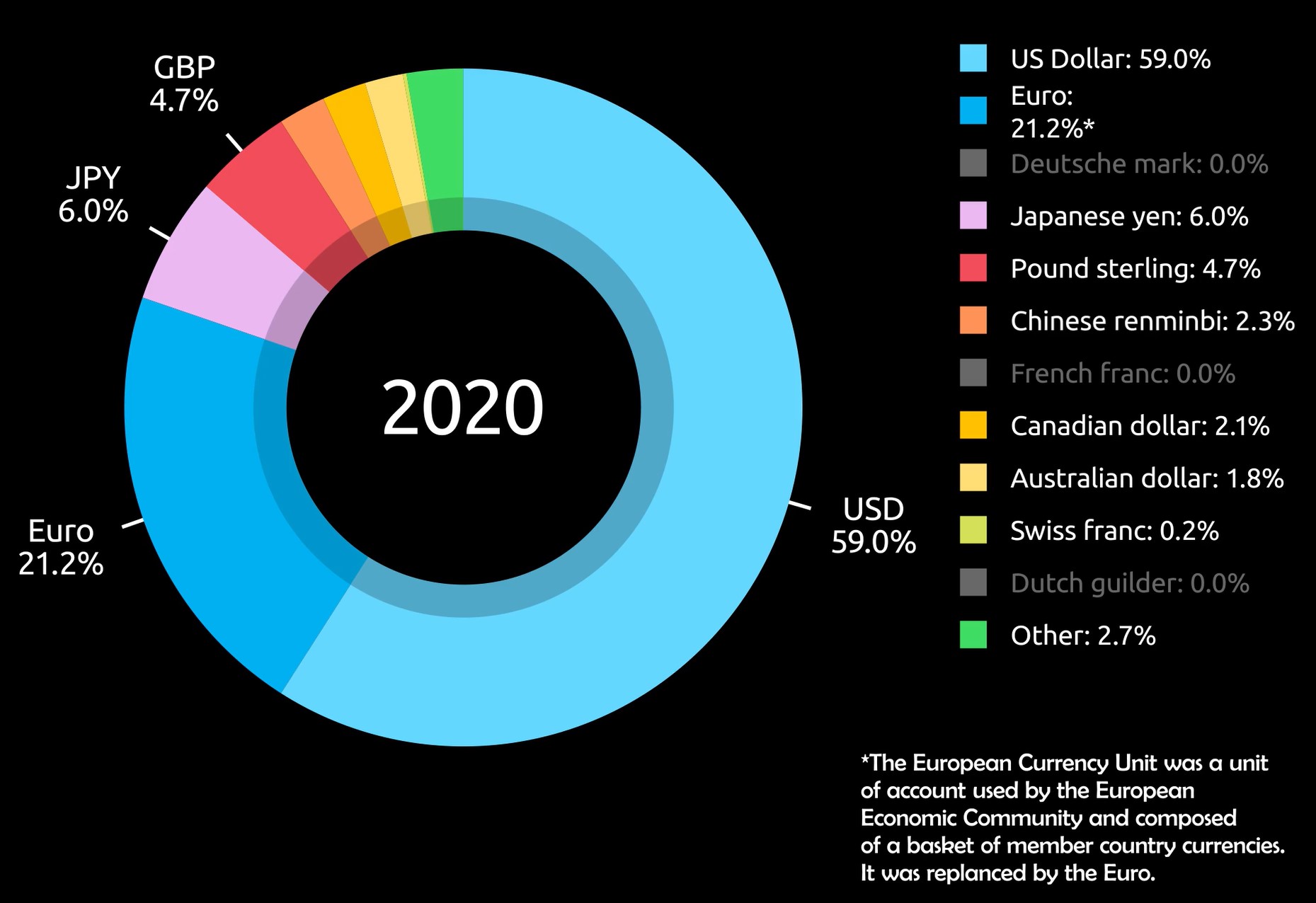

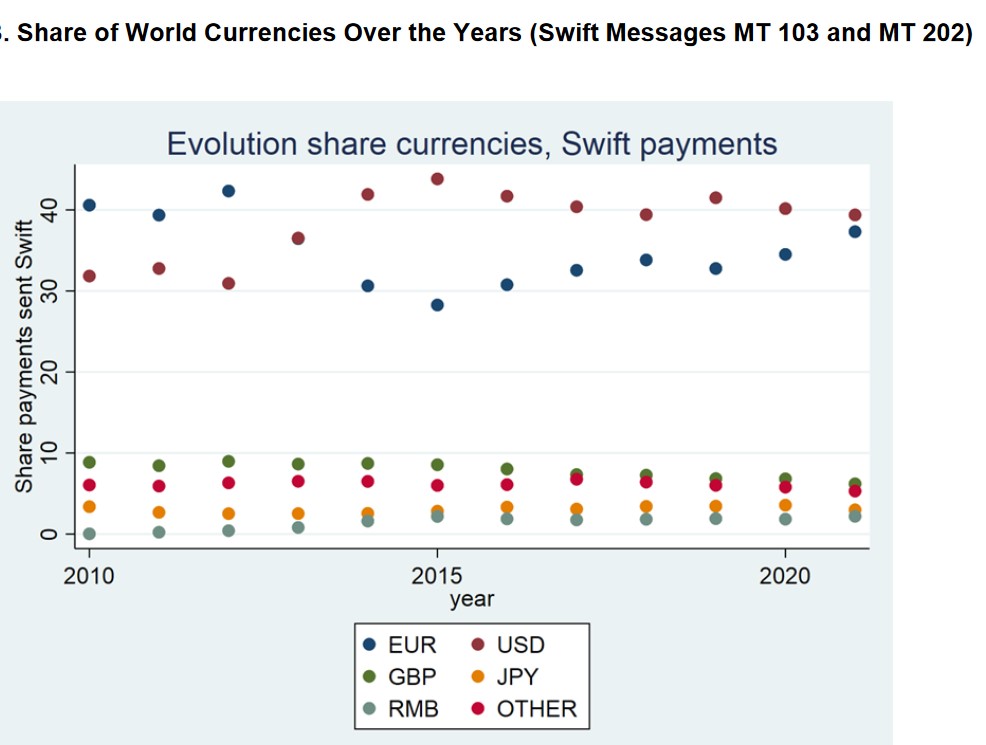

Now everything is changing rapidly. The dollar is leaving. According to the SWIFT international system, if in the early 2000s 66% of world trade transactions were carried out in dollars, now it is slightly more than 40%. The share of the dollar in the international reserves of countries has decreased from 71% to 60% over 20 years.

With the introduction of anti-Russian sanctions, the flight from the dollar only intensified. French expert Renaud Gérard writes in Le Figaro that the US finally weaponized the dollar when it seized the dollar assets of Russia's Central Bank: “The move to 'weaponise' the dollar was the freezing of the Russian Central Bank's foreign exchange reserves in 2022 after Putin launched a special operation in Ukraine. Non-Western leaders then said to themselves: 'If I fight my neighbor and Washington doesn't like this conflict, I could suddenly lose most of my foreign exchange reserves. So I need to cut back on dollar trading.'”

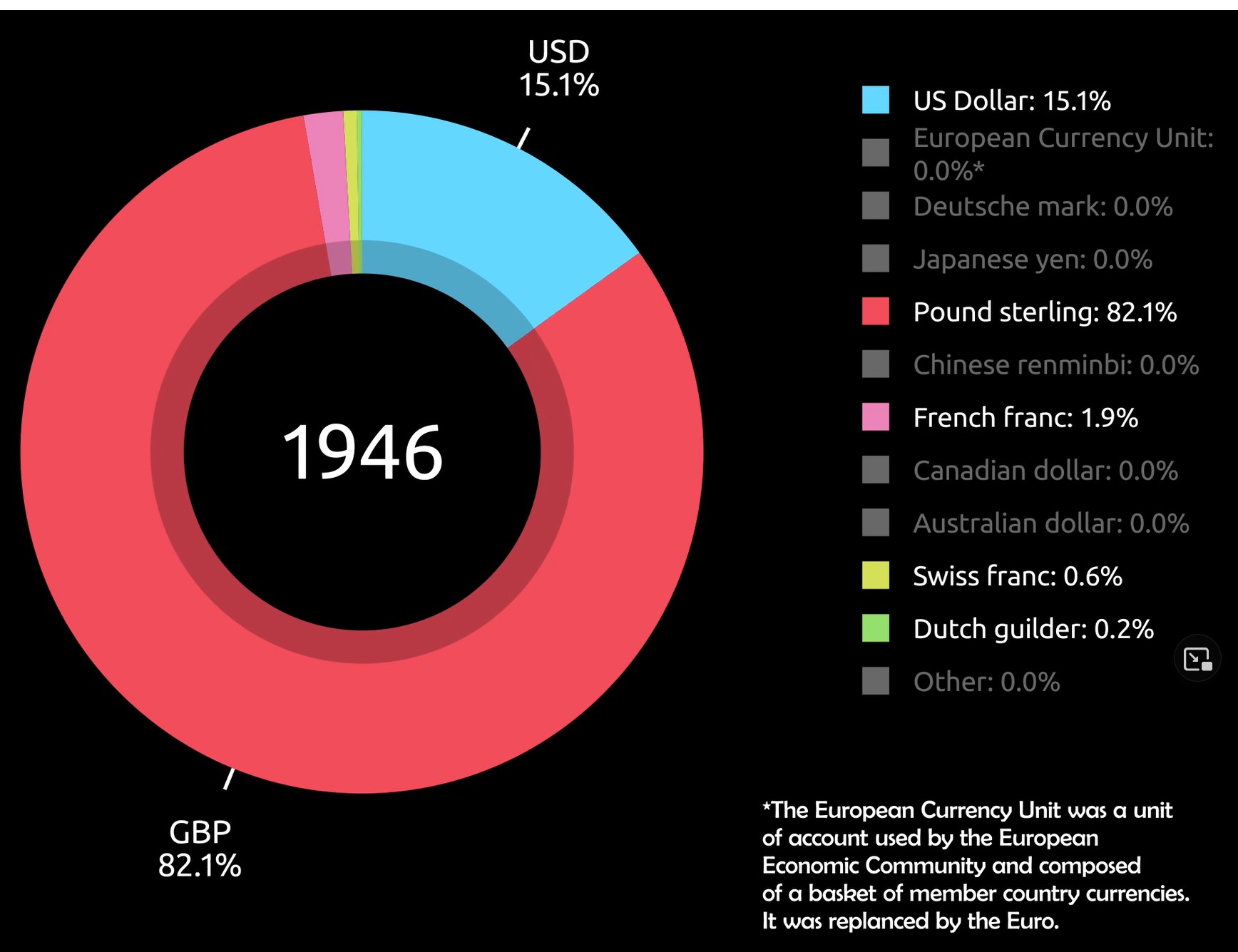

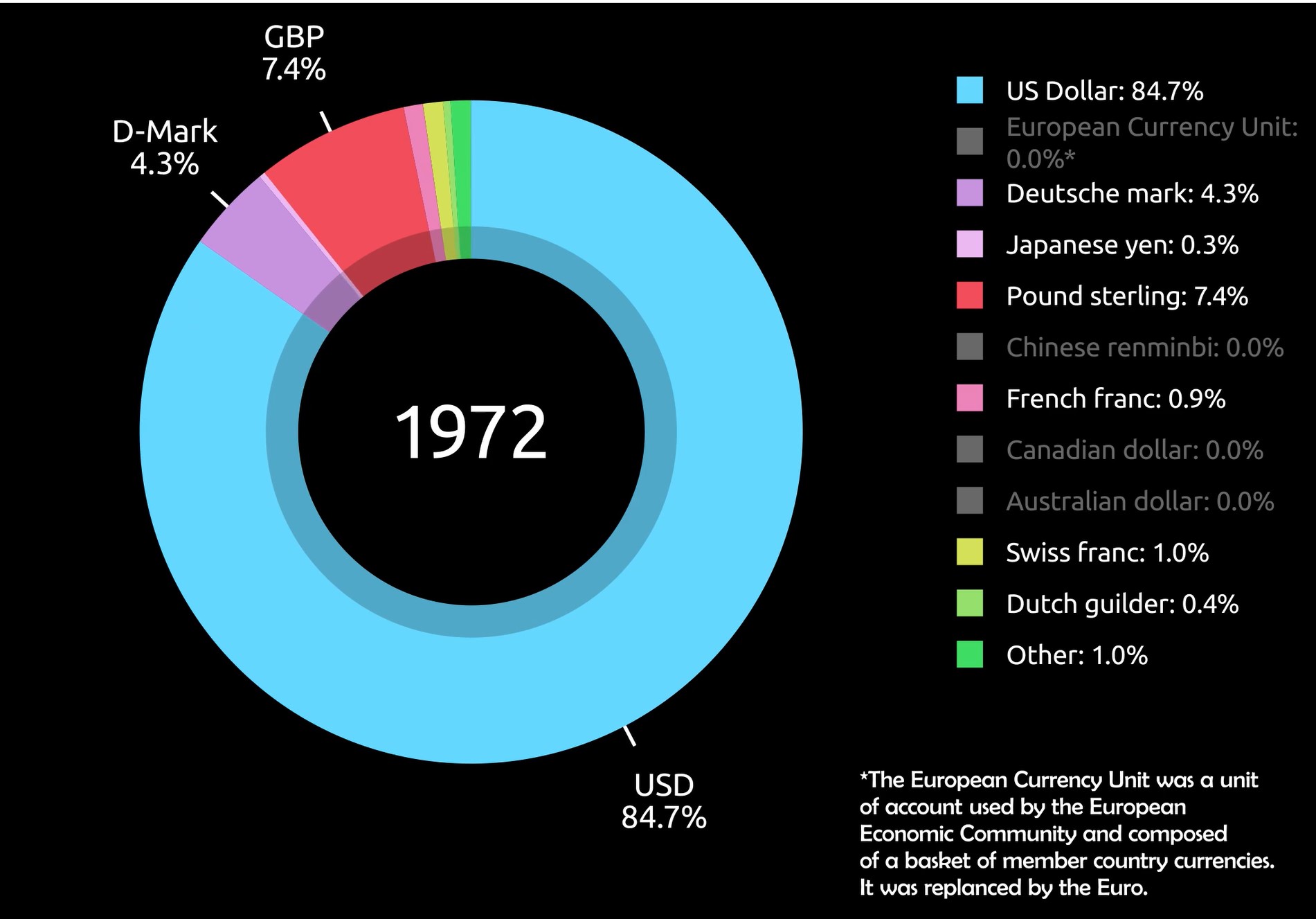

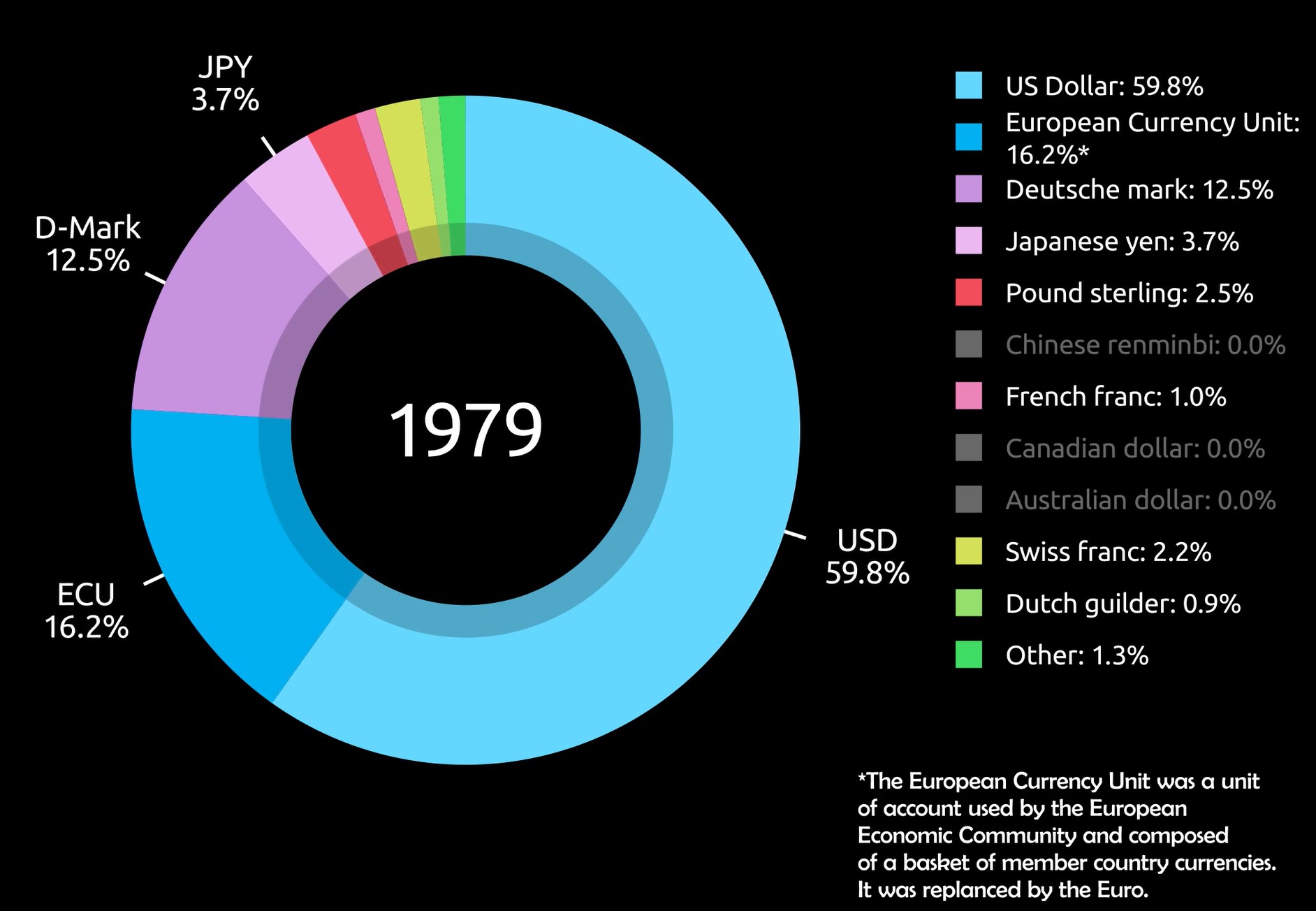

The data on the place of the dollar in world reserves and trade operations is correct, but sometimes you just need to choose good time points for comparison to get the desired result. In fact, the share of the dollar in reserves rose and fell; now it is far from both the historical maximum and the minimum.

As for the share of the dollar in transactions in the SWIFT system, in the early 2010s it was less than the share of the euro, but since then it has grown somewhat, and the dollar has again come out on top.

Renaud Girard, whom Kiselev respectfully calls an expert, is not an economist, but a political journalist, a supporter of the theory of "political realism", according to which great powers have the right to neglect the interests of small states and enter into any alliances in the struggle against the main opponents. In his Le Figaro article “The Dedollarization of the World,” he indeed called the freezing of the reserves of the Russian Central Bank a step towards turning the dollar into a weapon. But he did not explain what the dollar has to do with it.

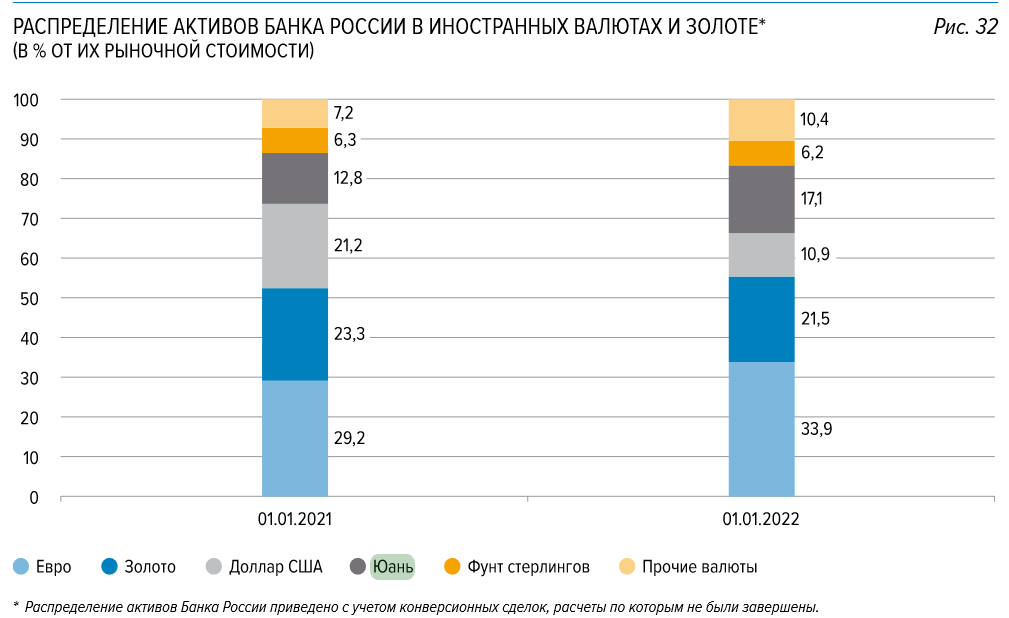

The decision to freeze reserves was made not only by the American, but also by the European authorities. Meanwhile, the share of the dollar in the reserves of the Central Bank of Russia at the beginning of 2022 was only 10.9%, while the share of the euro was 33.9%.

Why, then, Girard does not call it weaponization of the euro is unknown. Maybe only because he, like Kiselyov, is very fond of the idea of de-dollarization.